Overview

This vignette introduces readers to methods used by actuaries to analyze and model insurance claims data, specifically, how to apply Loss Reserving techniques.

NOTE:

- This vignette is specific to Loss Reserving (also known as claims reserving) for Property and Casualty (P&C, or general, non-life) insurance products.

- In particular, this vignette walks through some of the basic, yet essential, analytic tools actuaries use to assess the reserves on a portfolio of P&C insurance products.

Life Cycle of a Claim

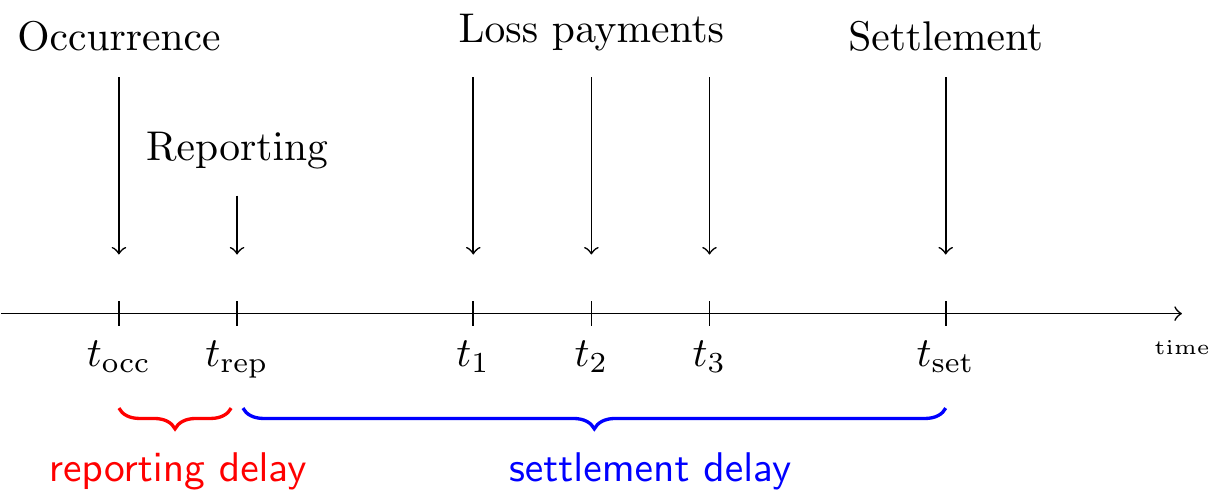

Our starting point is the Lifetime of a P&C Insurance Claim.

The figure below pictures the development of such a claim over time and identifies the events of interest:

The insured event or accident occurs at time . This incident is reported to the insurance company at time , after some delay. If the filed claim is accepted by the insurance company, payments will follow to reimburse the financial loss of the policyholder. In this example the insurance company compensates the incurred loss with loss payments at times , and . Eventually, the claim settles or closes at time .

Various Events throughout Life of a Claim

The different types of claim transactions over the life of an individual insurance claim could include:

- Establishment of the initial case outstanding estimate

- Notification to the reinsurer if the claim is expected to exceed the insurer’s retention

- A partial claim payment to injured party

- Expense payment for independent adjuster

- Change in case outstanding estimate

- Claim payment (assumed to be final payment)

- Takedown of case outstanding and closure of claim

- Reopening of the claim and establishment of a new case outstanding estimate

- Partial payment for defense litigation

- Final claim payment

- Final payment for defense litigation

- Closure of claim

These events can be summarized in a unified Claim Fact Summary Document:

| Policy Period | January 1, 2020 to December 31, 2020 |

| Date of Accident | February 18, 2020 |

| Date of Claim Report | March 3, 2020 |

| Date | Transaction | Reported Value of Claim to Date | Cumulative Paid to Date |

|---|---|---|---|

| March 3, 2020 | Case Outstanding Reserve of $15,000 Established for claim. | $15,000.00 | $0.00 |

| April 1, 2020 | Claim Payment of $1,500 - Case reduced to $13,500 (-$1,500) | $15,000.00 | $1,500.00 |

| May 12, 2020 | Expense Payment to IA of $500 - no change in case. | $15,500.00 | $2,000.00 |

| September 1, 2020 | Case increased to $30,000 (+$16,500) | $32,000.00 | $2,000.00 |

| October 3, 2020 | Claim thought to be settled with additional payment of $24,000 - case reduced to $0 (-$30,000) and claim marked as Closed. | $26,000.00 | $26,000.00 |

| January 15, 2021 | Claim Re-Opened with case outstanding set at $10,000 for claim and $10,000 for defense costs. | $46,000.00 | $26,000.00 |

| February 19, 2021 | Final defense cost payment for an additional $6,000 - case for defense costs zeroed out and claim set to Closed. | $52,000.00 | $52,000.00 |

As you can see there is quite a lot of detail that a single insurance claim can contain over the course of its lifetime.

It is important to note all the various important Dates associated with each claim:

- Policy effective date is the date the insurer issues the insurance policy (January 1, 2020)

- Accident date, or date of loss, is the date the covered injury occurs (February 18, 2020)

- Report date is the date the insurer receives notice of the claim (March 3, 2020)

- Transaction date is the date on which either a case outstanding transaction takes place or a payment is made (see all the dates in the preceding table)

- Closing dates are the dates on which the claim is initially closed (October 3, 2020) and finally closed (February 19, 2021)

- Reopening date is the date the insurer reopens the claim (January 15, 2021)

Viewing Claim Historical Transactions with lossrx

lossrx provides some convenient helper functions for

viewing the timeline and informative details over the course of an

individual claim’s lifetime by pulling the specified claim’s transaction

data directly from the Actuarial Database:

claims <- claims_transactional

# get a random claim

claim <- claims[round(runif(1, 1, nrow(claims)),0), "claim_id"][[1]]

# gather claim history

claim_history <- view_claim_history(claim, claims_data = claims)Claim Historical Timeline

Note: Click on a Date to view information about the transaction that occurred.

Claim History Details

| Claim ID | Claimant | State | Accident Date | Report Date | Close Date |

|---|---|---|---|---|---|

| claim-7706 | al-Shehata, Tayyiba | CA | 2015-06-13 | 2015-06-24 | 2018-12-06 |

Claim Transactional History

| Transaction Date | Paid Details | Case Reserve Details | Reported Details | Status Change | Cumulative Paid | Cumulative Case Reserve | Cumulative Reported |

|---|---|---|---|---|---|---|---|

| 2015-06-24 | Paid: Increased by $21,934.00 | Case Reserve: Increased by $160,820.00 | Reported: Increased by $182,754.00 | NEW -> Open | $21,934 | $160,820 | $182,754 |

| 2015-10-09 | Paid: Increased by $1,465.00 | Case Reserve: Increased by $50,353.00 | Reported: Increased by $51,819.00 | Open -> Open | $23,400 | $211,173 | $234,573 |

| 2015-12-06 | Paid: Increased by $2,332.00 | Case Reserve: Increased by $31,376.00 | Reported: Increased by $33,708.00 | Open -> Open | $25,732 | $242,549 | $268,281 |

| 2016-01-18 | Paid: Increased by $2,779.00 | Case Reserve: Decreased by $-2,878.00 | Reported: Decreased by $-99.00 | Open -> Open | $28,511 | $239,671 | $268,182 |

| 2016-03-16 | Paid: Increased by $2,327.00 | Case Reserve: Increased by $16,339.00 | Reported: Increased by $18,666.00 | Open -> Open | $30,838 | $256,010 | $286,848 |

| 2016-05-03 | Paid: Increased by $1,249.00 | Case Reserve: Decreased by $-29,425.00 | Reported: Decreased by $-28,176.00 | Open -> Open | $32,087 | $226,585 | $258,672 |

| 2016-06-12 | Paid: Increased by $8,098.00 | Case Reserve: Increased by $22,579.00 | Reported: Increased by $30,677.00 | Open -> Open | $40,185 | $249,164 | $289,349 |

| 2016-08-01 | Paid: Increased by $853.00 | Case Reserve: Decreased by $-6,467.00 | Reported: Decreased by $-5,615.00 | Open -> Open | $41,037 | $242,697 | $283,734 |

| 2016-10-03 | Paid: Increased by $23,658.00 | Case Reserve: Decreased by $-14,985.00 | Reported: Increased by $8,673.00 | Open -> Open | $64,695 | $227,712 | $292,407 |

| 2016-12-04 | Paid: Increased by $13,966.00 | Case Reserve: Increased by $8,418.00 | Reported: Increased by $22,384.00 | Open -> Open | $78,661 | $236,130 | $314,791 |

| 2017-01-24 | Paid: Increased by $5,410.00 | Case Reserve: Decreased by $-25,896.00 | Reported: Decreased by $-20,486.00 | Open -> Open | $84,071 | $210,234 | $294,305 |

| 2017-03-16 | Paid: Increased by $666.00 | Case Reserve: Increased by $16,536.00 | Reported: Increased by $17,202.00 | Open -> Open | $84,737 | $226,770 | $311,507 |

| 2017-05-23 | Paid: Increased by $753.00 | Case Reserve: Increased by $4,477.00 | Reported: Increased by $5,229.00 | Open -> Open | $85,489 | $231,247 | $316,736 |

| 2017-06-16 | Paid: Increased by $3,253.00 | Case Reserve: Increased by $25,981.00 | Reported: Increased by $29,234.00 | Open -> Open | $88,742 | $257,228 | $345,970 |

| 2017-08-14 | Paid: Increased by $3,190.00 | Case Reserve: Decreased by $-29,732.00 | Reported: Decreased by $-26,541.00 | Open -> Open | $91,933 | $227,496 | $319,429 |

| 2017-10-14 | Paid: Increased by $1,487.00 | Case Reserve: Decreased by $-4,549.00 | Reported: Decreased by $-3,062.00 | Open -> Open | $93,420 | $222,947 | $316,367 |

| 2018-02-13 | Paid: Increased by $2,618.00 | Case Reserve: Increased by $15,346.00 | Reported: Increased by $17,963.00 | Open -> Open | $96,037 | $238,293 | $334,330 |

| 2018-03-17 | Paid: Increased by $1,874.00 | Case Reserve: Increased by $22,543.00 | Reported: Increased by $24,417.00 | Open -> Open | $97,911 | $260,836 | $358,747 |

| 2018-06-19 | Paid: Increased by $3,086.00 | Case Reserve: Increased by $6,366.00 | Reported: Increased by $9,452.00 | Open -> Open | $100,997 | $267,202 | $368,199 |

| 2018-09-01 | Paid: Increased by $3,260.00 | Case Reserve: Increased by $1,510.00 | Reported: Increased by $4,770.00 | Open -> Open | $104,257 | $268,712 | $372,969 |

| 2018-12-06 | Paid: Increased by $2,052.00 | Case Reserve: Decreased by $-268,712.00 | Reported: Decreased by $-266,660.00 | Open -> Closed | $106,309 | $0 | $106,309 |